On-chain data shows the Realized Price of the Bitcoin short-term holders lies at $86,800 right now, making the level one to watch.

Bitcoin Is Still At A Notable Gap From Short-Term Holder Cost Basis

In a new post on X, the on-chain analytics firm Glassnode has discussed the trend in the profit-loss status of the Bitcoin short-term holders. The indicator of relevance here is the “Market Value to Realized Value (MVRV) Ratio,” which keeps track of the ratio between BTC’s Market Cap and its Realized Cap.

Related Reading

The “Realized Cap” here refers to an on-chain capitalization model for the cryptocurrency that assumes the ‘real’ value of each token in circulation is the price at which it was last transacted on the blockchain.

Since the last transfer of any coin is likely to correspond to the last instance of it changing hands, the price at its time could be considered as its current cost basis. Thus, the Realized Cap is nothing, but the sum of the capital that the investors as a whole have used to purchase the cryptocurrency.

In contrast, the Market Cap represents the value that the holders are carrying right now. As the MVRV Ratio compares these two models, its value tells us about the profit-loss situation of the network.

The traditional MVRV Ratio measures this for the entire market, but the version of the metric that’s of interest in the current topic is that specifically for the short-term holders (STHs), investors who purchased their coins within the past 155 days.

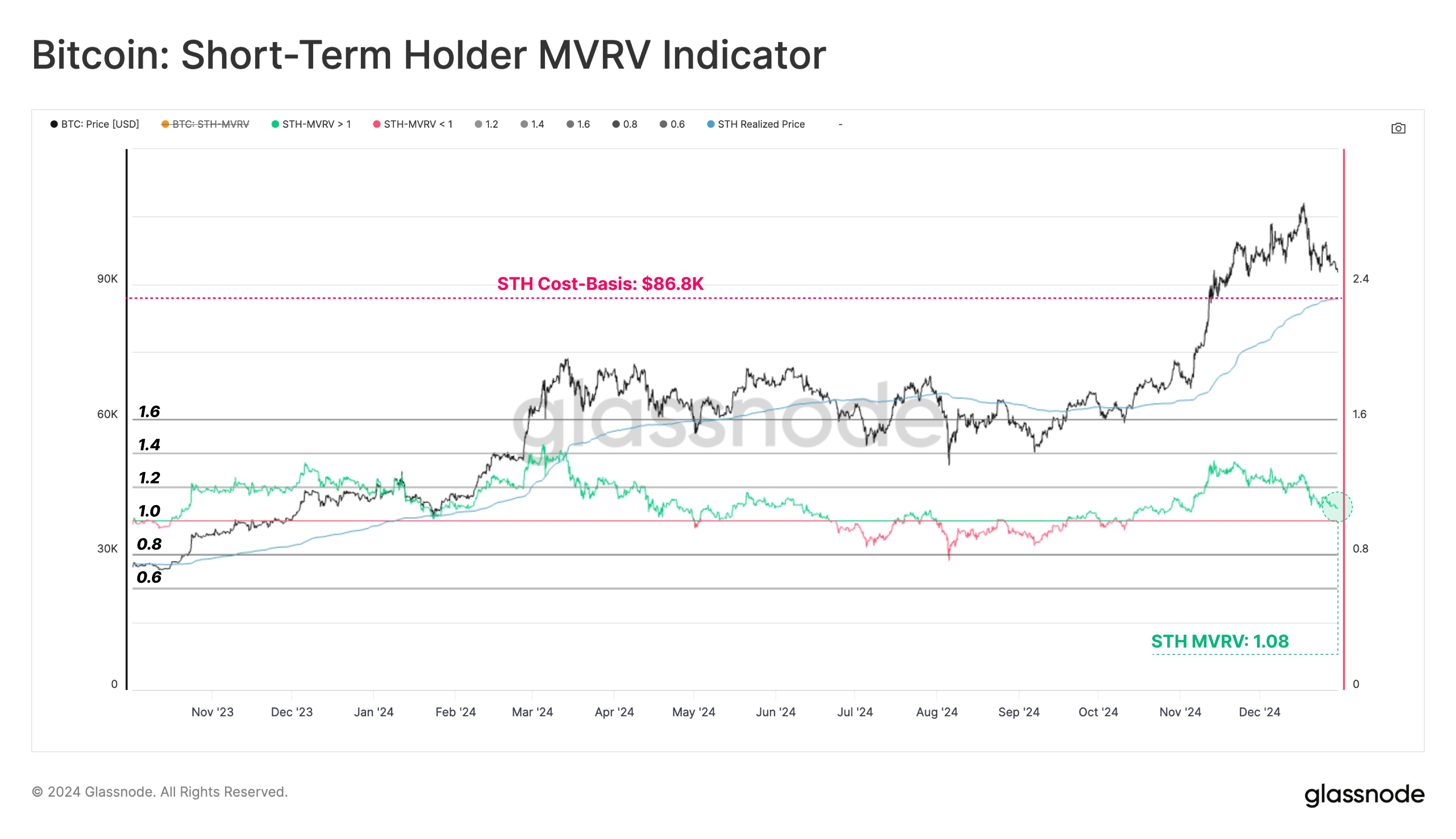

Below is the chart shared by the analytics firm that shows the trend in the Bitcoin STH MVRV Ratio over the past year or so:

As displayed in the graph, the Bitcoin STH MVRV Ratio spiked to notable levels above the 1 mark when the recent leg up in the BTC rally took place. The indicator being above this value implies the Market Cap of the group is greater than its Realized Cap, and so, the average member is in a state of profit.

Recently, as the decline in the cryptocurrency’s price has occurred, the indicator has naturally gone down. Its value still remains above the 1 level, though, suggesting profits held by the cohort still outweigh the losses.

At present, the STH MVRV Ratio is sitting at 1.08, which corresponds to the group holding unrealized gains of around 8%. Historically, the STHs have shown to represent the fickle-minded side of the market that easily participates in selloffs, so their being in large profits has tended to be a danger sign for the price.

The cohort is no longer making significant profits after the drawdown, but perhaps a cooldown may need to happen if the risk of profit-taking has to go away. A metric that makes it convenient to track when this could happen is the “Realized Price,” which is derived from the Realized Cap by dividing it with the total number of tokens in circulation.

Related Reading

From the chart, it’s visible that the STH Realized Price has a value of $86,800 right now, which means the group will be just breaking-even on its investment if Bitcoin falls to this level.

BTC Price

Bitcoin briefly fell under the $92,000 level yesterday, but the coin has found a small rebound as its price is now trading around $94,500.

Featured image from Dall-E, Glassnode.com, chart from TradingView.com